Your Membership May Be HSA/FSA Eligible*

EXERCISE IS MEDICINE

We are excited to announce that through our partnership with Truemed, you may be eligible to use pre-tax dollars to pay for your membership.*

What is an HSA/FSA?

Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA) are tax-free accounts that can be used to pay for qualified health expenses. These accounts are usually set up and managed by an HSA or FSA administrator, and you should have access to said HSA/FSA administrator through your employer (ask your HR department!).

Unfortunately, HSAs and FSAs are not available outside of the US, and self-employed individuals (who do not have an HSA from a previous employment) do not qualify for HSAs or FSAs.

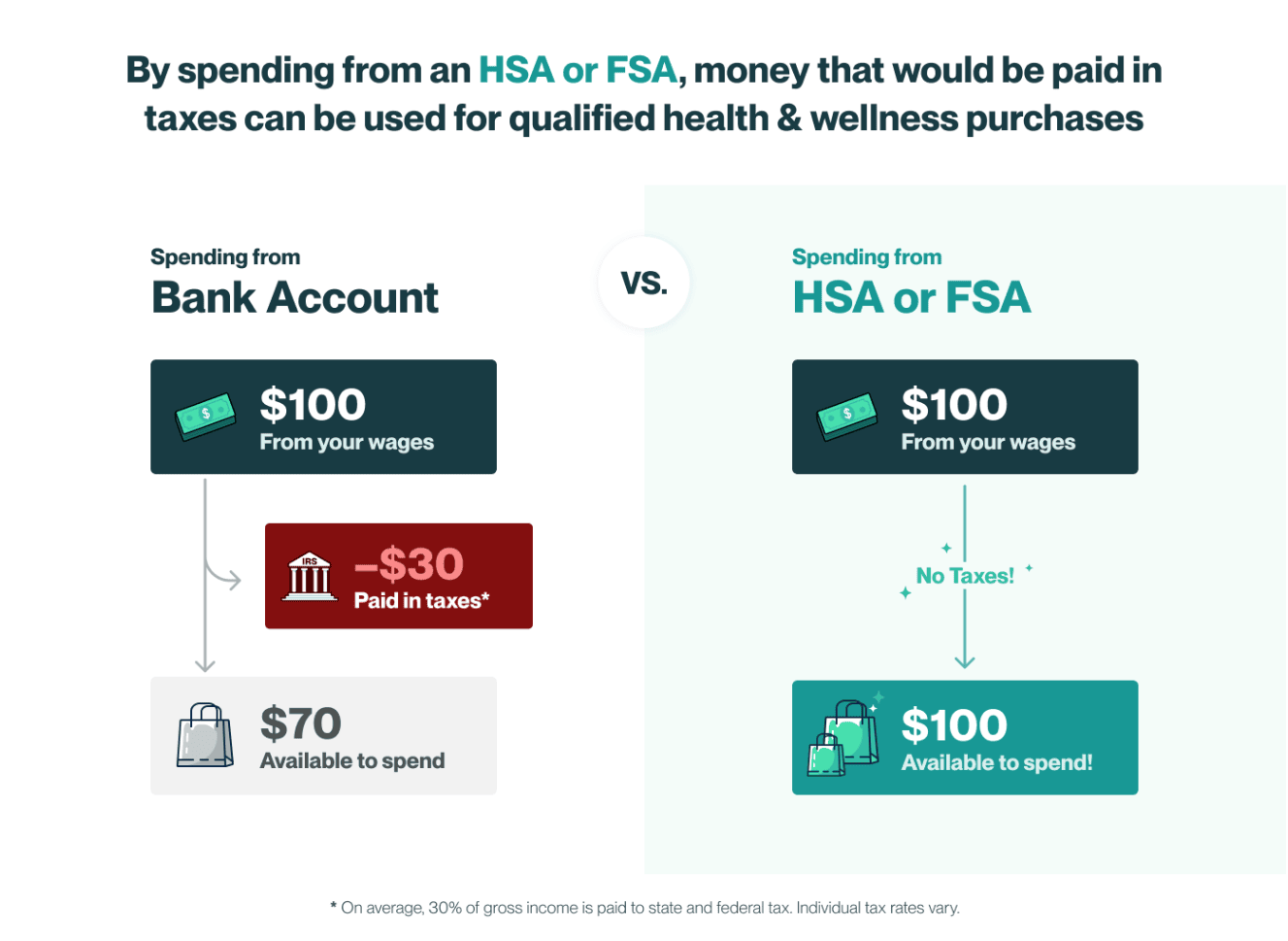

Because these are pre-tax dollars, they are not subject to taxes that have been paid before we receive most of our spendable dollars, resulting in an average savings of 30%*, depending on your tax bracket.

By spending from a HSA or FSA, money that would be paid in taxes can be used for qualified health and wellness purchases

HOW TO GET STARTED

3 SIMPLE STEPS TO GET GOING:

Take an evaluation survey from Truemed that will be reviewed by a licensed practitioner for $30.

If eligible, Truemed's licensed practitioners will issue you a Letter of Medical Necessity (good for 12 months).*

Truemed will send you instructions to obtain reimbursement from your HSA/FSA administrators.

FAQ

How long does the process take for a customer to receive a letter of medical necessity?

Typically, after submitting your survey, you will receive your letter via email in less than 48 hours.

How long does a letter of Medical Necessity Last?

It lasts for 12 months, then you can apply for another one if you would like.

Can I use my HSA/FSA card at checkout?

We do not recommend attempting to checkout with your HSA/FSA cards for compliance purposes. We strongly encourage simply transacting with your normal credit or debit card, and submitting for reimbursement as outlined above for the greatest likelihood of success.

What is the step-by-step process for submitting to HSA/FSA administrators for reimbursement?

Check out this article to get a comprehensive understanding of the reimbursement process.

I have more questions. Who can I reach out to?

Truemed is happy to answer any questions that you may have about the process. Reach out to their team at support@truemed.com.

*Truemed is for qualified customers. HSA/FSA tax savings vary. Learn more at truemed.com/disclosures.